So I like to trade options and have recently switched to TD Ameritrade, who has a fairly robust desktop platform, thinkorswim. In fiddling around, the documentation is alright, but some of the terms and details are not really gone into, leaving you scratching your head. In the Spread Hacker section, I was curious about a few different parameters since I primarily want to trade vertical credit spreads. Those columns are “Max Profit”, “Prob of Profit” and “PL/Margin”.

Max Profit

This sounds like it should be simple to figure out what it means. Most people would think that it is the max profit of the spread, however it is expressed as a percentage. A percentage of what? What on earth is this?

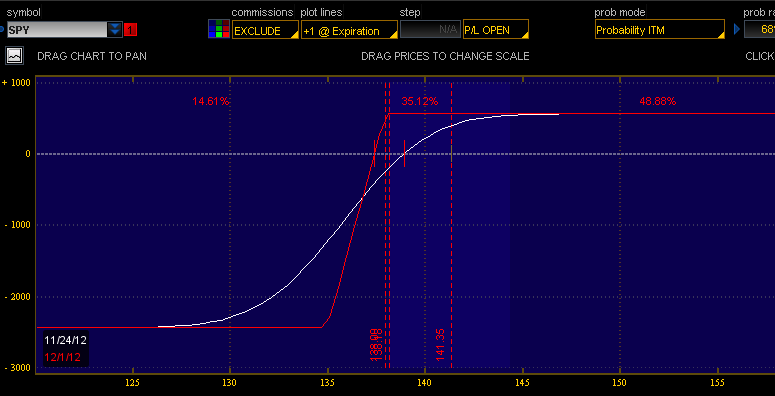

It turns out it is actually the maximum profit on the spread divided by the maximum risk. For example, if I am selling 10 136/137 SPY PUT spreads for $0.20 (which means that the SPY is above 137, and I am short the 137 PUT), then my maximum profit is $200 ($200 = 10 contracts * 100 multiplier * $0.20 per contract). My maximum loss is $800 ($800 = difference between the strikes $1 * 100 multiplier * 10 contracts – credit.

That means that my “Max Profit” as thinkorswim calculates it is 25%. I am risking $4 to make $1.

Prob of Profit

This is simply the the probability of the short strike (the one closes to the current price) being out of the money (OTM) at expiration. The last part is very important because this percentage is not all that useful to American Style options since they can technically be exercised at any time they are in the money. What we really want is the probability of touching, which is also an option in the thinkorswim platform.

So just remember that this number is likely much more optimistic than what it is in reality. If you are using European Style options (as is common against indexes), then it is an appropriate probability since those can only be exercised at expiration. Note that this probability is based off of Brownian Motion, is not exact.

PL/Margin

This one looks like they took “Max Profit” and just made it a number. Well, you are exactly right! It is simply (Max Profit / Max Loss) * 100. I am actually not sure why we need both calculations here. If someone can enlighten me, I would be grateful (just add a comment).

That is all for now.

2 responses to “Gems from thinkorswim – Spread Hacker Terms”

Leave a Reply

You must be logged in to post a comment.

You are wrong in the discussion of American option in “Prob of Profit”.

It is not when one is allowed to exercise an American option that is of concern but when is optimal to exercise. American option can be exercised any time and that means the profit would merely be above zero or any minute positive number. That is obviously absurd. If there is no dividend, it is optimal to exercise American call at its expiry. In other words, without dividend, an American call is just another European call. For put, it is only optimal exercise early when the interest rate is high. For options on futures, there is not much difference between American and European options, put or call.

Therefore, the probability of profit (POP) at expiry is the relevant probability to examine, not the probability of touch (POT), as you said. Your characterization of POP is wrong, too. You definition is for the Out Of The Money probability (OTMP). The definition of POP is the probability the stock price is below the short strike plus the option (in your case credit vertical spread) premium. So POP < OTM probability.

Also, POT = 2* OTMP, approximately.

I’m reviving an old post! (since i really like the Think-or-Swim platform)

So while it’s true that Max Profit & PL/Margin is the same for some spreads (like Verticals)…it isn’t true for all spreads (like Calendars & Diagonals) since they have complicated margin requirements (Vertical’s margin & loss are the same).